Top 5: Financial tips international college students should know

Studying abroad can be an exciting and fresh new experience for international students, but managing money can be a big challenge.

In fall 2017, some 1,323 undergraduate students from foreign countries were attending the University of Massachusetts Amherst and 389 of them are freshmen, according to UMass At A Glance. For most of these students, it’s their first time dealing with debit card issues and foreign money transactions, and language barriers often make this process even harder.

If you are an international student that suffers from money management, here are some useful tips for you to make saving money less painful.

1. Avoid transaction fees as much as you can

Whenever you need to pay something online that involves a transaction fee, don’t rush to click the “pay” button. Scroll through the payment methods and you are very likely to find one called “eCheck” which is an electronic version of a paper check. This transaction method works almost the same as a real check (and helps save the environment, too).

Zhi Wang, a senior management major at UMass and foreign exchange student from China had to pay not only his tuition fee but also a $995 transaction fee during his freshman year, which he could have saved by using eCheck.

“I didn’t notice that there was an option called eCheck. I wish I could have asked someone before I made the payment, ” said Wang.

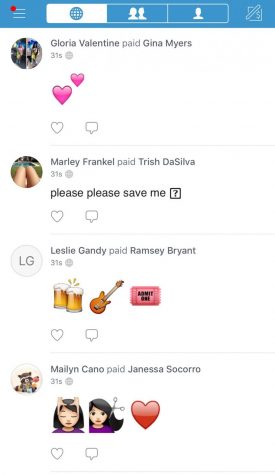

Transaction fees also occur when you transfer money to a different bank. One way to avoid transaction fees is to use an app called Venmo. The online service owned by PayPal allows you to make transactions with your debit card or bank account for free. You can pay and request money with a message or some emojis, which makes the process much more fun and interactive.

2. Separate tuition fees from others

Due to the inconvenience of the transaction process in a foreign country, international students are likely to have a large amount of money in their bank accounts to cover their living expenses and tuition for months, or even years. The problem is, how do you resist the temptation of using next year’s tuition to buy yourself some nice clothes and shoes?

Banks offer a tool called a Certificate of Deposit (CD) for people to set aside their savings and earn more interest. By opening a CD, you are putting your money into a bank with a fixed maturity date and an interest rate that is higher than the one your regular savings account offers. If you withdraw money before it matures, you have to pay penalties. These vary depending on the maturity of the CD — for example, the cost for early withdrawal of a 6-month CD is equal to three months interest. However, you can have a better idea of how much money is left for your daily expenses when your tuition and other inevitable costs are in a separate account.

3. Get the most from your rewards credit card

If you have a social security number, then congratulations, you are eligible to apply for a credit card! The next step is to learn how to use your credit card efficiently and wisely.

Cecilia Huang, a junior hospitality and tourism management major at UMass and foreign exchange student from China said she received $90 as a cashback reward last year after spending more than $100 on her Discover credit card.

The $90 reward is a combination of a $20 cash back on purchases, a $50 statement credit for referring a friend and a $20 cashback bonus as a good grade reward for maintaining her GPA above 3.0. Hard work literally “pays off” in such way, right?

The reward programs may vary within different banks so remember to choose the one that best fits you.

4. Take advantage of online communities

This semester, Hyejeong Kim, a sophomore management and accounting double major at UMass and foreign exchange student from Korea spent $388 on textbooks and an iClicker. She said college students in Korea could buy cheap used textbooks from others in online communities, and she was unsure if she could do the same thing in the United States.

Nowadays, you can find everything that you can think of on social media. If there is an online community in Korea, it’s possible that there is one here as well. You can go to your Facebook page and search: “your school’s name” with “free and for sale.” For UMass students, the group is called “UMass Free And For Sale.” Joining the group allows participants to browse items such as cheap microwaves, cameras and even inexpensive lease deals! It’s also a great opportunity to connect with others.

5. Ask the right person

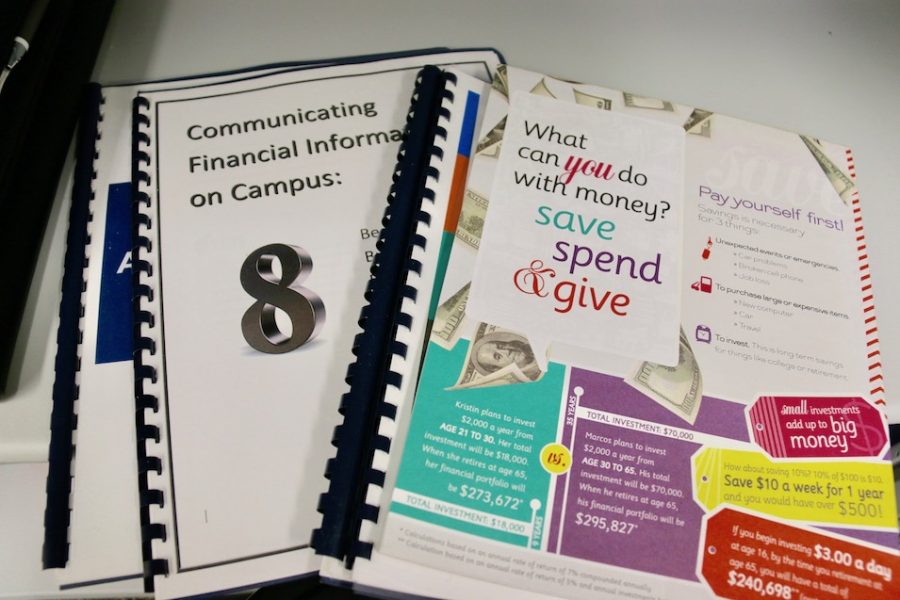

If you have questions about finance, the International Programs Office is a great place to go. Students can consult with UMass’ S.A.M., or “Smart About Money,” a student-run group established to promote financial literacy on campus.

The S.A.M. program holds several events throughout the year to help students. Last November, it organized free rides for students to wherever they needed to go on campus, and the drivers, members of S.A.M., provided financial advice along the way. Not only can international students without cars benefit from a free ride, but the financial advice is equally as helpful. Check out their site for upcoming events.

Managing money may be a topic that sounds overwhelming, but whenever you have a problem, don’t hesitate to ask people.

Erin Zuzula, the bursar of UMass, advises every student to come to the bursar’s office for any questions.

“We are not here to just collect the money. We are here to help in any way we can,” said Zuzula.

Email Sylvie at [email protected], or follow her on Twitter at @sylviefan_Jour.