Alexandria Ocasio-Cortez’s 70 Percent Tax Rate

Ocasio-Cortez’s ambitious tax plan would completely change how the ultra-wealthy are taxed in the US.

Franmarie Metzler; U.S. House Office of Photography

Alexandria Ocasio-Cortez. (Wikimedia Commons)

Alexandria Ocasio-Cortez’s (D-NY) 70 percent tax rate on the ultra-wealthy in the United States has been debated heavily ever since she announced it. Cortez, a popular Democratic House member from New York, hopes that her proposed tax rate would finance her “Green New Deal” and reduce carbon dioxide emissions throughout the United States.

Cortez’s tax rate of 70 percent would only affect people whose income exceed 10 million dollars. Her goal is to protect America’s best interests by having the most wealthy Americans pay their fair share in taxes. Currently, a person who is earning $550,000 a year pays the exact same marginal rate as someone who is earning 50 times as much. Not only does this not make sense, but it is unfair because wealthy people who are earning millions should be paying at a higher rate because they can afford to.

In a poll from The Hill-HarrisX, 59 percent of respondents said they agreed with Cortez’s plan of putting a tax rate of 70 percent on people’s 10 millionth dollar and beyond — even 45 percent of Republicans supported the tax hike. Although some people believe Cortez’s plan is political suicide. It is not that uncommon in American politics considering in 1980 an income above 216,000 dollars, which would be 658,213 currently, was taxed at a 70 percent rate.

Presidents Dwight Eisenhower and Richard Nixon, Republican party favorites, each implemented marginal rates of 91 and 70 percent, so Cortez’s plan is really not as radical as conservative pundits have been saying. Since then, the wealthiest Americans have only become richer while the middle class has stayed stagnant. As a result of that, 90 percent of America’s wealth is distributed among the top 160,000 richest families.

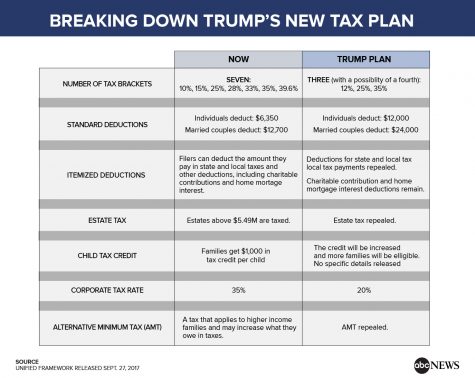

President Trump’s 2017 Republican Tax Act that was boasted to help the middle class and provide them with significant tax refunds was just reported by the IRS to actually decline from totals last year. The refunds are 22.2 billion dollars, which is a decrease of last year’s 28.9 billion dollar total according to data released from the IRS. This data is alarming considering that 75 percent of taxpayers in the United States count on this refund. For houses with low-income, tax refunds are the largest cash infusion of the year.

According to an article written by David Dayen from Vice, Ocasio-Cortez’s tax plan would have yielded 74.4 billion dollars more to that compared in 2016. Utilizing that 74.4 billion dollars over 10 years, it would result in 744.4 billion dollars that would be beneficial for America. The excess money can help form and facilitate Ocasio-Cortez’s “Green New Deal,” which hopes to combat economic inequality and climate change within America.

(Wikimedia Commons)

Instead of the middle class benefiting from the tax plan as promised, millionaires and corporations were the true winners.

According to a report from the Joint Committee on Taxation, millionaires in total saved 17.4 billion dollars. Once the United States taxpayers see their tax refunds, it is going to present both Trump and the GOP with a difficult position to defend against the Democrats before the 2020 presidential election.

Considering that high-profile Democratic senators such as Kamala Harris (D-CA) and Corey Booker (D-NJ) and Elizabeth Warren (D-MA) are embarking on their Presidential campaigns, they will take a position that shows that they will work for a tax plan that is more beneficial for the American people.

Ocasio Cortez’s idea of taxing the ultra-wealthy in America even has support from one of the nation’s most successful and richest people, Warren Buffett. Although he did not formally address Cortez’s plan, he supported the idea of higher taxes for people like himself. Even Democratic primary favorites such as Elizabeth Warren and Bernie Sanders have supported the “ultra-millionaire taxes” and estate taxes on wealthy citizens of the United States.

Email Nicholas at [email protected].